It takes bold thinking to transform the retirement industry — our innovative technology is leading the way

Best-in class awards1

- - Participant website functionality

- - Online tools and services

- - Plan sponsor website and tools

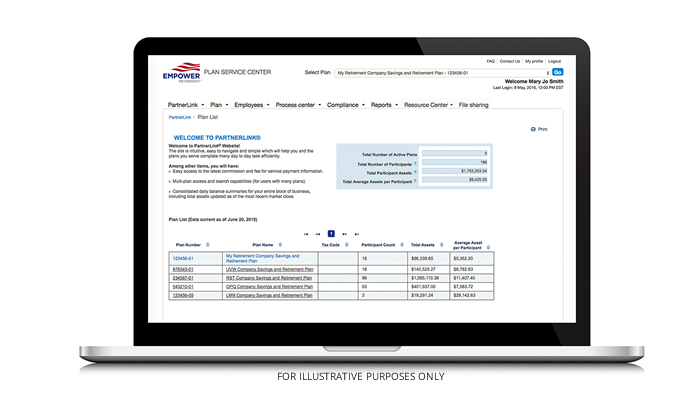

PartnerLink®

PartnerLink is designed to give our advisor and third-party administrator partners an in-depth view into our recordkeeping system to more efficiently service their clients. PartnerLink empowers our partners to have accurate and current information across their business by providing:

- The same information that plan sponsors see within the Plan Service Center

- A view into their block of business with Empower

- A list of all associated plans, as well as combined plan, participant and asset information

- Cross-plan reporting that allows access to specific information across all plans at once

- Payment information, whether it be commissions or fee-for-service based

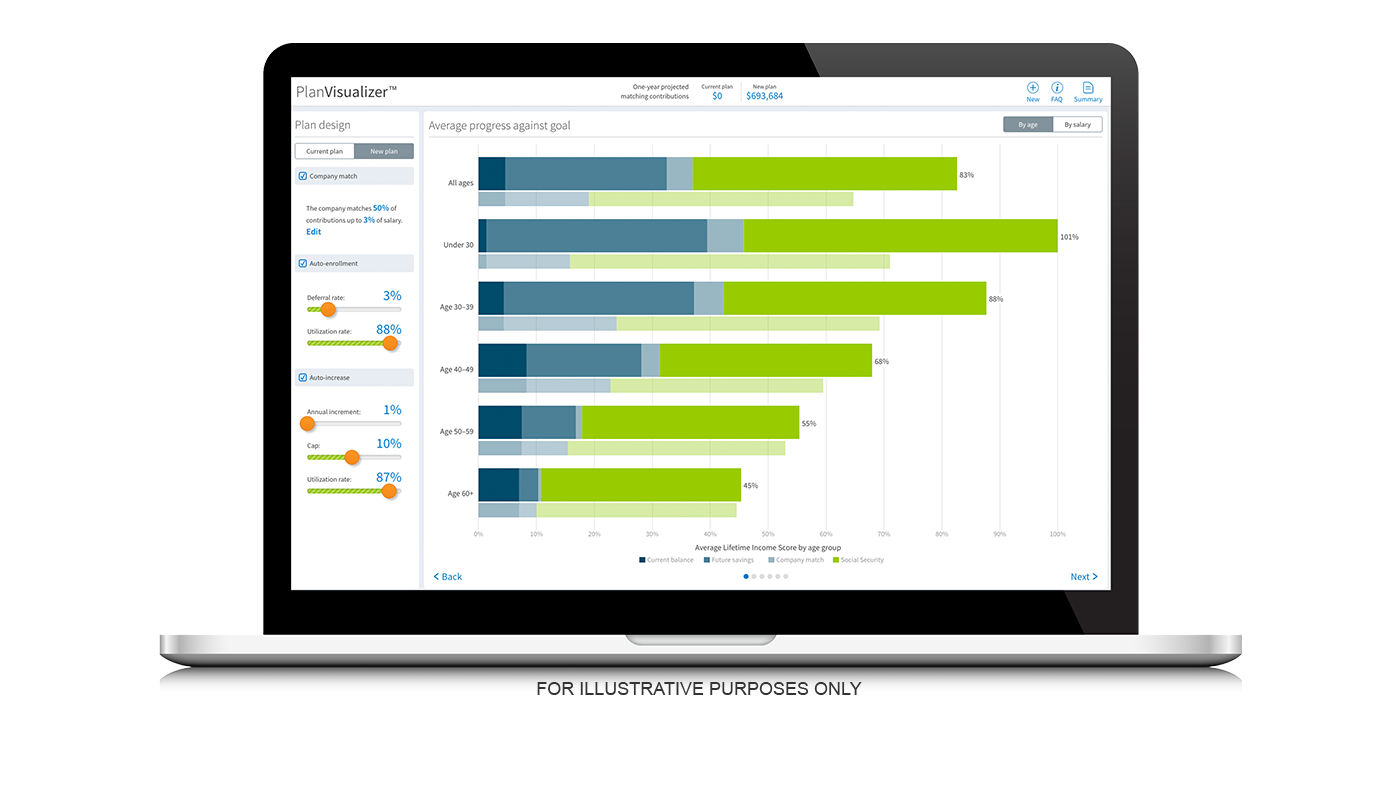

PlanVisualizer™

This powerful application provides a view of retirement plans like never before and makes it easier to help optimize plan design.

- Get an unprecedented view of plan data

- Model plan features and costs

- View retirement readiness of participants

- Compare participant savings in the current plan versus potential plan enhancements

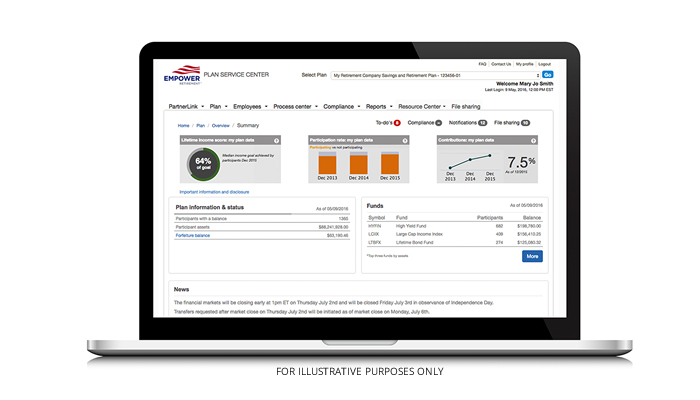

Plan Service Center

The Plan Service Center (PSC) gives you an intuitive view into all the vital elements of your clients' plans and allows plan sponsors to quickly and easily manage their plan with single-click access.

- Easy access to retirement and healthcare savings balances, asset allocations and plan activity

- State-of-the-art user interface

- Quarterly site updates and enhancements

The PSC simplifies plan management and maintenance. By putting the information right at their fingertips, they can see how specific segments of their plan are tracking toward an established goal.

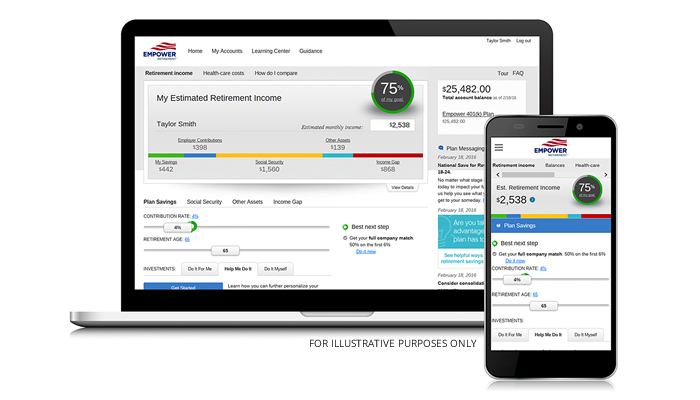

Participant website

Participants receive a personalized view of their projected monthly retirement income. They can quickly and easily see where they stand, how far they need to go and what steps they can take next.

- Translates savings into estimated monthly income

- Lets participants request changes immediately to their portfolio

- Allows account access anytime via any device

- Displays healthcare savings balances

Participants also have access to resources that encourage them to save more. As part of the Empower participant experience, participants receive a view of their estimated healthcare costs and if they participate in the Empower HSA, they have the ability to also review their healthcare savings. They can make changes to their retirement savings and healthcare savings accounts in one place and see them immediately. Plus, participants can see how they compare with top savers and easily take action.

See more about our participant offeringsProprietary recordkeeping platform

By owning and developing our recordkeeping system, we can ensure that you and your clients receive state-of-the-art services. The flexible server-based architecture enables real-time services and full integration of trust and recordkeeping services.

Choose to combine our proprietary recordkeeping expertise with any number of other services to best suit your needs

Our flexible, scalable platform grows as their plan grows. Plus, our integrated system delivers real-time reporting with greater accuracy and efficiency.

1 PLANSPONSOR Defined Contribution Survey — best-in-class awards, October 2015

2 Based on participant website usage data for the period January 1, 2013, through May 30, 2015. Users are defined as participants who logged on to the website and moved the deferral rate slider at least once.

Not all product offerings and services are available in all states or to all plan sizes and types. Please contact your Empower Retirement representative to determine what is available for your situation.

By electing Empower HSA, plan participants are contracting directly with Optum and its affiliates OptumHealth Financial Services, Inc., for this service. Great West Life & Annuity Insurance Company (GWL&A), or its subsidiaries or affiliates, is not responsible for the services offered by Optum. GWL&A, including its broker dealer subsidiary GWFS Equities, Inc. is not affiliated with Optum.

Not all features are currently available. Some features are under consideration and/or in development. Presented for discussion purposes; non-binding and subject to change without notice.

Health savings accounts (HSAs) are individual accounts offered or administered by Optum Bank®, Member FDIC, and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties. State taxes may apply. Fees may reduce earnings on account.

Investments are not FDIC insured, are not guaranteed by Optum Bank®, and may lose value.

The content of this communication is not intended as legal, investment or tax advice. Optum Bank is not a broker-dealer or registered investment advisor and does not provide investment advice or research concerning securities, make recommendations concerning securities or otherwise solicit securities transactions. Investments are self-directed, and HSA owners should read the prospectus carefully and consider their individual financial situation, goals and objectives along with the fund's investment objectives, risks, charges, expenses and fees before investing.

All Optum trademarks and logos are owned by Optum. All other brand or product names are trademarks or registered marks of their respective owners. Because we are continually improving our products and services, Optum reserves the right to change specifications without prior notice. Optum is an equal opportunity employer.

Unless otherwise noted: Not a Deposit | Not FDIC Insured | Not Bank Guaranteed | Funds May Lose Value| Not Insured by Any Federal Government Agency